The Romans Abramovich can owe £ 1bn unpaid tax

BBC and File News in 4 investigates

BBC

BBCThe Russian Russian Oligarc could owe the UK to reach £ 1bn after written tax avoidance from the Hedge Fund Investment, the BBBC testimony.

Mature papers reveal the investment of $ 6BN (£ 4.7bn) to the British Virgin Islands companies (BVI). But evidence indicates that they are controlled in the UK, so they should have been taxed there.

Another financial sustained FC for Chelsea FC in which Mr Achomovich is managed from being followed from companies involved in the program, BBC and the Bureaue of the Invormatism (TBIJ).

Oligarch’s lawyers say that they “stay independent of taxes and legal advice” and “act in accordance with that counsel”. He denies that he has knowledge or personally responsible for any unpaid tax.

Joe Powell, the MP of Labor Gourd the Required Taxed Mixmen, called HM Revenue and Customs “urgently” to investigate what can be money “.

In the heart of the scheme was Eugene Shvty, Director of Chelsea FC and Billionaire Billionaire in his truth, challenging the UK government decision to see him about his close contact with MY Abramovich connection.

Mr Shvixler moved to USA after Russia’s attack in Ukraine, but from 2004 until 2022 he stayed in the UK, with buildings in London and Surrey.

Tax Expert Tell Mr Shvidr for strategic decisions during investment when supported in the UK, not “with a large smoking firearm.

Mr. SHVHler’s lawyers said the BBC sets up reporting its reporting “Preliminary Business Documents Bring an Imperfect Picture” and “dragged strong and faulty conclusions by Mr Spring.

They said the “shape of money” was a matter of carefree and detailed, made, and advised by the lead counselors “.

The scheme that involves Mr. Investment in Mr. Abramovich.

GETTY photos

GETTY photosThe BBC and the media’s partners, including the Guardian, has been reporting to mature files since 2023 as part of the International Consortium of investigators’ Cyprus is a secret an investigation. Tuesday, we revealed that Mr Abramovich had Million combined with VAT at an active cost of his ships yacht.

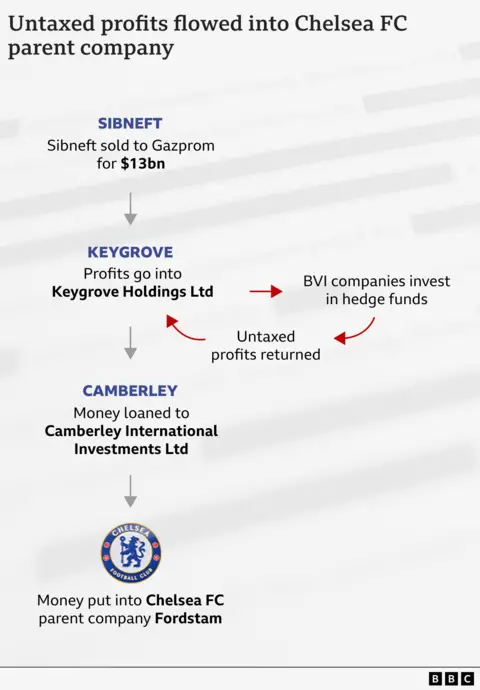

The mature information indicates Mr Abramovich method invested part of the riches he received in the 1990s Corruptable agreement – Incing to the BVI company called Keygrove Holdings Ltd.

Inethiwekhi yezinkampani zaseBrithani Islands izinkampani eziphethwe yimali eshibhile le mali – kuze kufike ku- $ 6bn (£ 4.8bn) phakathi kwama-1990s asema-2020s – ngamafayela avuthiwe, ngokusho kwamafayela avuthiwe.

This investment makes Oligarch an estimated $ 3.8BN (£ 3.1bn) the profit approximately twenty years. By making money from BVI, he or she does not pay taxes to the benefit of the organization, the program appears to be set to ensure that small tax payable.

‘Full Power to Do Whatever’

It is not uncommon for businesses to officially avoid paying taxes for their benefit by making their investment in the tax portals. But the companies involved should be controlled and controlled at the sea when installed.

If Offshore Company’s strategic decisions are taken by a person in the UK, its profit may be taxed as if the UK company.

Mature documents indicate how BVI investment guides gave the flow of the flow of Mr Shvixer, who lived in the UK and received a British citizen in 2010.

The BBC saw the “typical documents” Power of Attorney “written between 2004 and 2008, who gave him” the wide power “that performs all and anything” in the plants in BVI.

Since 2008, Mr Shvidr seems to have strengthened the ability to direct a demonstration of showing investment, which had BVI companies, through another company.

Mellenium Capital Ventures Ltd, who had indirectly by Mr Shvixler’s wife appointed her Director in 2000, became Keygrove’s financial management. It is allocated “full potential and authority of guidance and administration” investment of goods, “all without the previous consultation”.

“Strong Evidence”

Another evidence that Mr Shvidr role in the investment decisions of BVI companies came out in the court case delivered on September 2023 by the US Security Commission against York Firm called Councor.

The SEC fills means a Concord has only one client, as identified as Milo Abramovich. The company is advised for investment decisions on Oligarch company.

It points to “a long time near” Mr Mrsamovich, mentioned as “a person B”, making investment decisions “for Mr. Abramovich.

He says he was “a point that the contact was to receive investment advice” and “to decide whether to decide whether to proclaim with commendation”.

Using mature documents, BBC was able to see that “person b” as Eugene SHVHER.

The evidence shows that Mr Shvither makes the decisions described by sec, treating and regulating Mr Abramovich investment, from UK instead of BVI.

GETTY photos

GETTY photosTax Expert Rita de Lia Feer told BBC to be a UK citizen, like Mr SHVHler’s “Hedge” in Fummenty Hedge Fummenty

“I think this is a huge smoking gun. That will be, and, powerful evidence that the actual corporate treatment was not possible in BVI,” he said.

Mr. SHDRI’s lawyers will not have Mr Shvty’s question, either careless or carelessly, involved in an illegal program to avoid paying taxes “.

The Mr. Abramovich lawyers said more than his counsel, “expects the same advice to be” the responsible for the working companies related to him.

Mature writings also reveal that how much the profitability of unattended benefit from Mramovich’s Hend Inundentment has passed on Oligarch Companies network before flowing to Chelsea FC.

Investment of the Sohedge Fund is flowing back to his companies in the BVI and is deceptive, their parents company.

The Keygrove then borrowed money from Mr Nner Abramovich’s network, which borrowed money in Campabereley International Investment Ltd – a company set out in Bankroll Chelsea FC.

In 2021, when Chelsea won the Champions League, Club World Cup and UEFA Super Cup, hundreds of millions of rand from the club can be followed back to the benefits of the Investment Feed Regenacy.

How to calculate the bill

If HMRC will investigate, how much is Mr Abramovich or affected companies owe the career?

We examined the benefit made by invested companies since 1999 to 2018.

Mature documents only contain the full accounts for investment companies in the Hedge Funds from 2013 to 2018.

However, we may limit whether access to companies may have been done throughout the time by looking at “the Fiscal”. These are the benefit stored in businesses, rather than paid for shareholders. At the end of 2018 this is up to $ 3.8BN.

Using the UK tax rates and refund of cash in earnings to 2012, and the annual benefit of 2018, reaches the tax bill of more than $ 500m for the HMRC.

GETTY photos

GETTY photosBut in the event of an investigation into unpaid tax, the HMRC may also place a late payment interest in the finals of failing to inform the authorities.

If the tax does not have, so it goes on the investigation that he knows that he knows those who are faithful but could not, whether they could not, the total amount to come from about $ 1bn to more than £ 1bn.

It may be promoted for another benefit cannot be obtained, as the HMRC investigation may return only after 20 years.

However, our calculation may be a very low point, because we have used the lowest rate of the organization that was present between 1999 and 2012, and the possibility was removed from companies, then we did not put in that time.

In any event, Mr. Abramovich’s tax payable may be DWARF £ 653m deposited in formula one boss Berne in Cclestone in 2023.

Frame

Following the full russian attack in Ukraine, the British government allowed the Romans ARRAMVich to sell Chelsea FC to Todd Boohly. Do it regularly in the form that £ 2.5BN from the benefit will be given what you have supported by war victims in Ukraine.

About three years, the money remains in the Bark Barclays Barkwe, reportedly for the lack of use, Mr Mrsamovich who wanted to spend money “against the UK government should only be dismissed with the help of the people in Ukraine.

The BBC investigation suggests that, as Ukrainians expect the money from one of Chelsea, so the British taxpayer.

Cyprus is a secret International Investigations established by 2023 led by the International Consortium of Invissation Presorting (Cij) in Cyprus Firms to provide Russian President Vladimir Putin’s business services.

The Media Partners includes a Guardian, the newspaper newspaper Trail Media, the Italian newspaper L’espresso, organized crime and corruption and the burial iconary of Permiative Paronall (TBIJ).

TBIJ reported group: Simon Lock and Eleanor Rose.

Source link